How to Design Modern Government Payment Solutions That Build Public Trust

Key Takeaways

- Outdated payment systems create friction that reduces compliance and undermines public trust; modern portals, channels, and UX reverse that trend.

- Flexible options—partial, recurring, and scheduled payments—help residents stay current while reducing manual collections and exceptions.

- Government-ready solutions like CSG Forte BillPay let agencies modernize experiences and integrate with existing systems in phases, as the city of Kinston and Lucas County did.

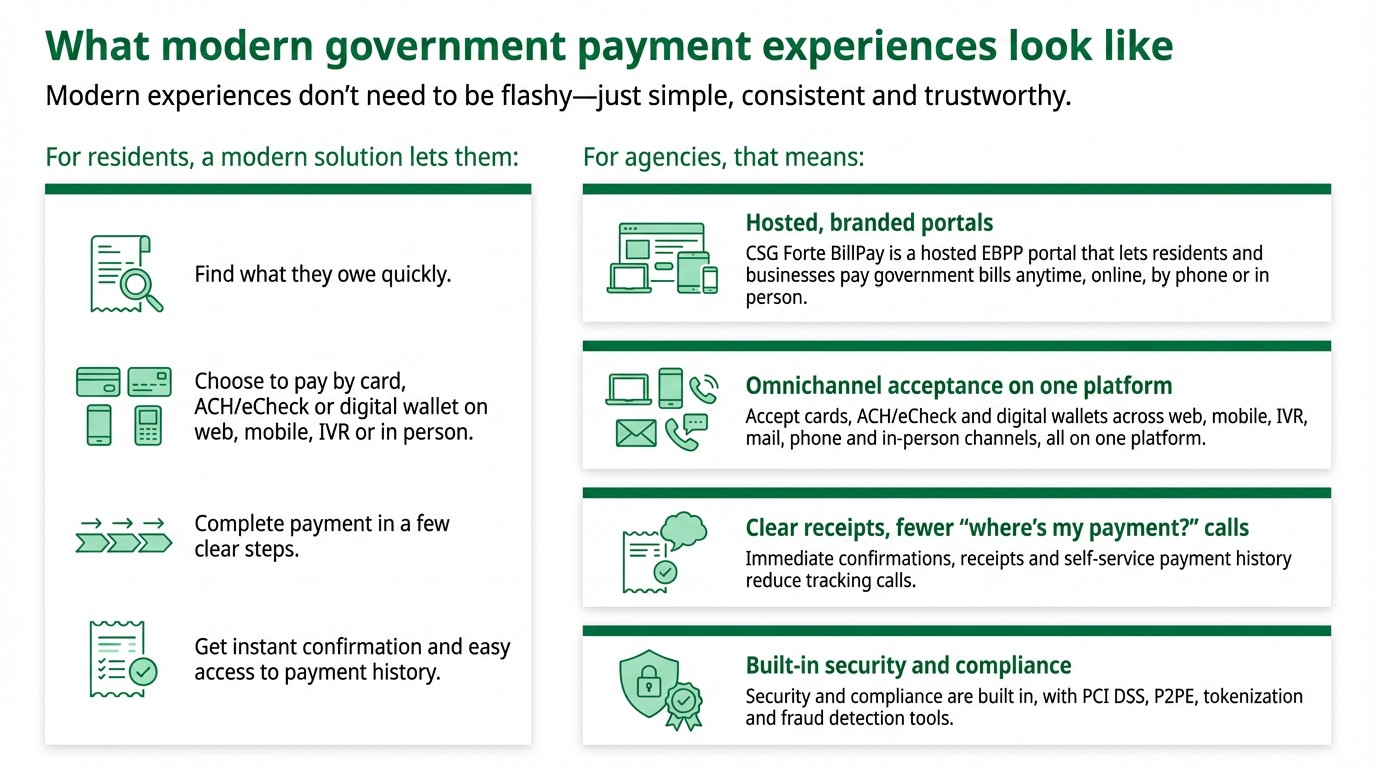

Residents do not wake up thinking about payment processing. They think about keeping their license current, avoiding penalties on their property tax bill, or paying a court fine on time. When those payments are hard to make, the result is more than operational pain for your office—it becomes a public trust issue.

Modern government payment solutions give treasurers, comptrollers, and finance leaders a practical way to close that gap. By making payments reliable, flexible, and secure across channels, agencies can improve compliance, reduce manual work, and increase resident confidence.

This article walks through what that looks like in practice—and how to get there without a risky, multi-year systems overhaul.

Why outdated payment systems erode trust and compliance

Legacy payment processes do more than slow collections. They send a message that the government is behind the times and hard to work with. That perception shows up directly in compliance and in the workload landing on your team.

Common pain points include:

- Limited ways to pay: Many agencies still rely on mailed checks and in-person payments for major obligations like taxes and fees. Lucas County, Ohio, for example, originally accepted tax payments only by mail and in person at the Treasury department, which limited options for residents and slowed processing.

- Clunky, abandon-prone portals: Residents often start a payment online, get stuck on an unclear step, and abandon the process—then call or show up in person instead. Internal planning work on government portals highlights “common friction points in government portals” and “UX issues that drive residents back to the counter or phone,” along with the need to measure completion and adoption rates, not just traffic.

- One-size-fits-all, lump-sum payments: Requiring residents to pay the full amount in a single transaction can unintentionally reduce compliance. Internal guidance on recurring and partial government payments notes that one-time, lump-sum obligations create real compliance challenges, especially for households juggling variable income or multiple obligations.

- Security worries and unclear protections: Public sector payment accounts are prime targets for fraud. A security brief for government payments points out that these systems face distinct threats, and that agencies need hardened login and account management flows, protection for stored payment methods, and effective monitoring and response processes.

If residents are not confident their data is protected, they are less likely to adopt digital channels.

Over time, these issues train residents to expect long lines, long hold times, and confusing online experiences—fueling complaints and making it harder to argue that your office is a good steward of public funds.

Support residents with flexible, accessible options

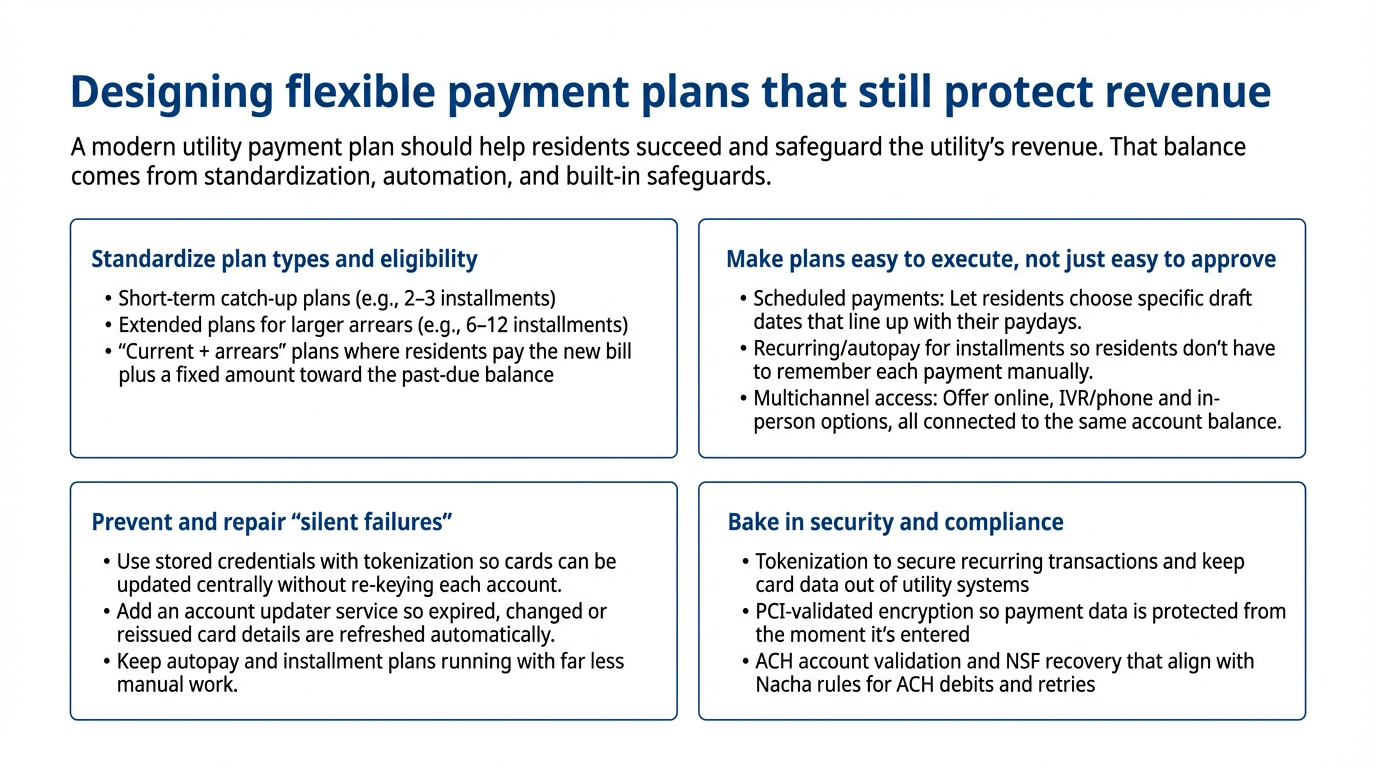

Compliance improves when you give people realistic ways to stay current. That means flexibility in both how and when they pay, without compromising policy.

Move beyond “pay in full or fall behind”: One-time, lump-sum payment requirements can create avoidable compliance challenges. In many cases, residents intend to pay but cannot absorb a large bill all at once.

Modern government payment solutions can support:

- Partial payments within defined thresholds

- Structured payment plans that spread obligations over time

- Over-pay options where appropriate (for example, pre-funding certain obligations)

Modern payment platforms allow agencies to configure schedule-pay, autopay, partial pay, and over-pay options in their hosted portals, with rules controlled by the agency.

That combination makes it easier for residents to take action early instead of waiting until they can pay in full.

Make recurring and scheduled payments easy: For obligations like installment taxes, recurring fines, or ongoing program fees, recurring, and scheduled payments reduce missed due dates driven by forgetfulness or poor timing. Recurring and partial payments can be direct levers to boost compliance, especially when combined with clear communication and good reporting.

Residents appreciate the ability to enroll in autopay or set up scheduled payments aligned with their pay cycles, using stored payment methods that are captured via PCI-compliant forms and tokenized for secure storage. This reduces manual collections work while giving residents more control.

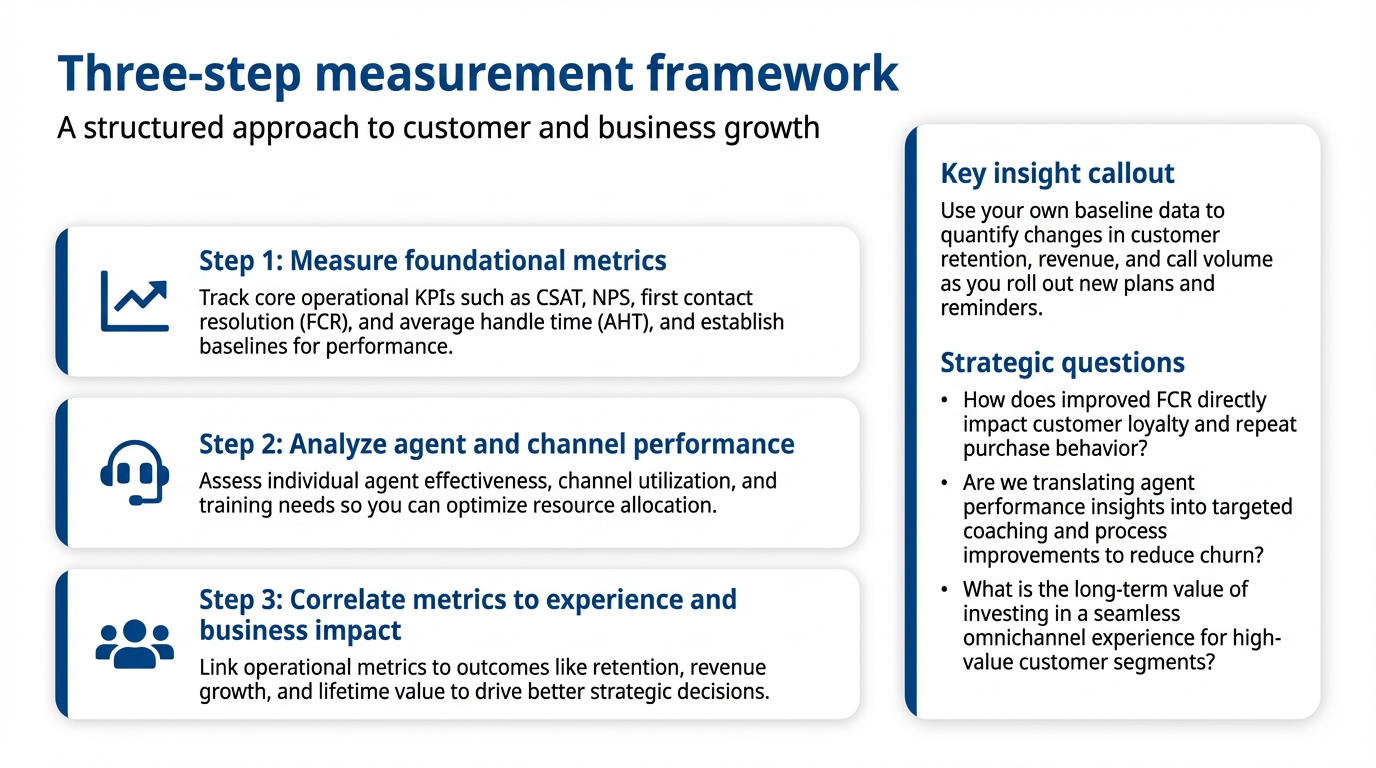

Design for accessibility and mobile use by:

- Fixing UX issues that drive people to complain

- Making portals accessible and mobile-friendly

- Measuring completion and adoption rates—not just traffic

Modern government payment portals are designed to be responsive and accessible from modern browsers on phones and tablets, and to support both guest and registered flows for different comfort levels.

When residents can complete a payment on the device in their hand—in a few accessible, well-labeled steps—they are far more likely to finish the transaction instead of abandoning it.

CSG Forte offers a modern, secure platform designed specifically to help the public sector address these challenges and deliver on the promise of flexible, accessible payments. By integrating user-friendly payment options and robust security features, our bill payment and presentment solutions empower agencies to meet residents where they are—without upending existing operations or sacrificing compliance standards.

Integrating payments with existing government systems

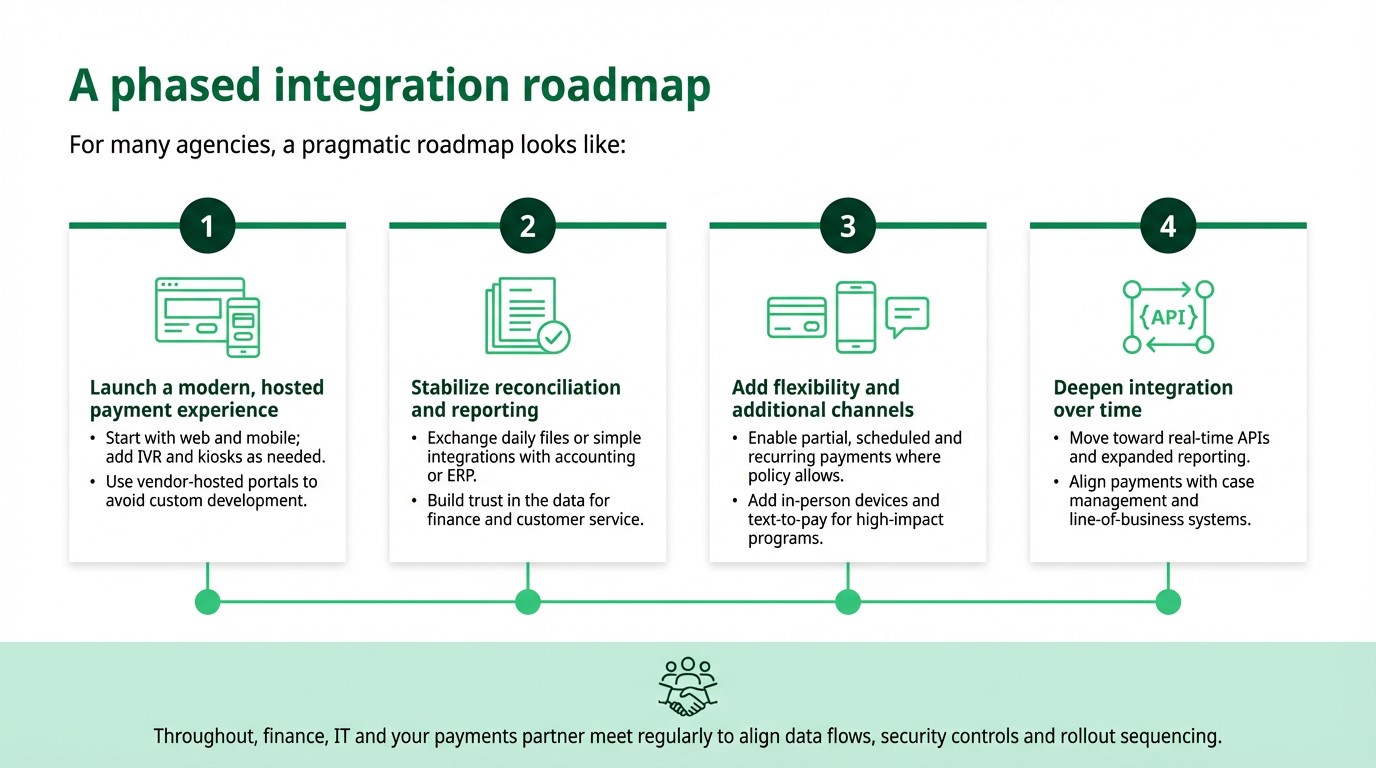

Finance and IT leaders are understandably wary of any project that sounds like “rip and replace.” Fortunately, payment modernization often succeeds through incremental integration rather than all-or-nothing change. The real-world impact of this approach is evident through the experiences of local governments that have successfully modernized their payment processes with CSG Forte.

City of Kinston: bridging a gap without rebuilding everything

The city of Kinston, North Carolina, needed to expand its electronic payment options. Residents could pay utilities by phone and at a kiosk, but not online, and other departments could not accept electronic payments at all.

Instead of rebuilding its core systems, the city:

- Used CSG Forte to build programming that bridged its enterprise resource planning (ERP) system and a payment interface.

- Implemented Secure Web Pay (SWP) Checkout to redirect residents from the city’s site to a secure, hosted payment page.

- Added IVR and other channels over time.

The results: after integrating more electronic payment options, Kinston saw 41% year-over-year growth in transactions processed and positive feedback from residents who appreciated the ease of use.

Staff now handle less cash and fewer checks, reducing bank fees and saving time.

Lucas County: modernizing tax payments with minimal disruption

Lucas County, Ohio, worked with CSG Forte to solve a paper-heavy process where residents could only pay taxes by mail or in person. A prior processor added electronic options but came with high fees and poor support.

By transitioning to CSG Forte, the county:

- Expanded card and eCheck options and added phone payments.

- Streamlined online tax collection with SWP Checkout.

- Retained its existing infrastructure, with the switch described as “pretty seamless.”

Over the first six years with CSG Forte, the Treasury department saw:

- More than 280% growth in annual transactions processed.

- A “vast reduction in posting issues.”

- Fewer taxpayer complaints about the fee structure.

These examples show that you can upgrade payment experiences and back-office reliability without tearing out core systems—especially when you start with hosted front-end experiences and standard file-based integrations.

Where CSG Forte fits in

Modernizing government payment solutions is not just a technology decision; it is a strategic choice about how you want residents to experience your agency.

CSG Forte’s government payments platform, anchored by BillPay and complemented by tools like Engage and Authenticate, is designed to help agencies:

- Offer secure digital payments across channels (web, mobile, phone, IVR, and in person).

- Provide flexible options like schedule-pay, autopay, partial pay, and over-pay where policy allows.

- Protect constituent data with PCI-validated P2PE, tokenization, and fraud/risk tools tailored to card and ACH payments.

- Reduce manual work with daily reporting and ready-to-reconcile files.

- Improve collections and public experience at the same time, as shown in Kinston and Lucas County’s results.

If your team is exploring government payment solutions that can meet today’s expectations without adding unnecessary complexity, it can help to talk through options with a specialist.

Now is the time to talk to a payments expert. Our team can help you map a practical path from where you are now to a more modern, trusted payment experience for the people you serve.

FAQs

What is a government payment solution?

A government payment solution is a set of tools that lets agencies present bills, accept payments (card, ACH/eCheck, and often wallets) across web, mobile, IVR, and in-person channels, and reconcile those payments with existing financial systems. CSG Forte BillPay, for example, is a hosted portal purpose-built for government and other billers.

Do we need to replace our core financial or ERP system to modernize payments?

Not necessarily. Many agencies start with a hosted portal and file-based integrations, then deepen connections over time. Kinston and Lucas County both modernized tax and utility payments by bridging existing systems to CSG Forte’s hosted checkout and reporting tools, rather than rebuilding their ERPs.

How do recurring and partial payments help with compliance?

Internal government content notes that one-time, lump-sum payments can create compliance challenges, especially for residents facing variable income. Recurring and partial options make obligations more manageable, improving on-time payments when paired with clear policies and communication.

How do modern solutions address security for public sector payments?

Security briefs for public sector accounts stress the need for hardened login, account management, and data protection. CSG Forte’s platform is PCI DSS-compliant, supports PCI-validated P2PE for in-person card transactions, and uses tokenization to keep sensitive data out of agency environments.

What results have other governments seen from modernizing payments?

Lucas County increased annual transactions by more than 280% over six years while reducing posting issues and fee complaints.

Kinston saw 41% year-over-year growth in transactions after expanding electronic options, along with positive resident feedback.