Going Digital: Understanding Merchant Services Providers

Cash has long been king, but its reign is quickly winding down.

Today, customers increasingly prefer electronic or digital payment methods for several reasons: ease of transfer, remote purchase capabilities and security, to name a few.

If your business doesn’t already accept credit cards, debit cards and other electronic payments, you’ll want to rethink that strategy before falling further behind—digital transactions accounted for 30% of all point-of-sale (POS) transactions and 50% of all online sales in 2023, and those shares are only expected to increase.

To get your company online, able to accept digital payments, you’ll need to partner with a merchant services provider (MSP). And, especially if you’re new to the online payments world, with all its regulations, compliance requirements and data protection laws, you’ll need to make sure and choose the right payments partner.

What Is a Merchant Services Provider?

A merchant services provider is a go-between company that acts as a mediator between your business and credit card companies and/or banks. If your company wants to accept multiple forms of payment beyond cash, it needs to work with a partner that offers secure merchant services.

The goal of most MSPs is to facilitate and secure the payment process for companies and their customers. Along with acting as the intermediary between banks and your company, an MSP may also allow you to connect your online and physical stores’ payment systems, ensure you stay compliant with security regulations and offer customer support.

Depending on your needs, your MSP may provide services such as payment processing, payment gateways, POS devices and merchant accounts.

Merchant Account Provider vs. Payment Gateway

Payment gateways and merchant account providers fall under the merchant services provider umbrella. In some cases, an MSP may provide both payment gateway and merchant account services.

Merchant account provider: Your company will need a merchant account to accept credit and debit cards. The merchant account provider holds funds for you while bank authorization occurs. Once the authorization is complete, the money is transferred from the merchant account to your bank account.

A merchant account isn’t the same as a typical bank account. While the money in the account technically belongs to your business (provided the credit or debit card company approves the transaction), you can’t directly access the money and withdraw it as you would funds in your savings or checking account.

Instead, you must rely on the account provider to transfer the money from the merchant account to your business bank account. The merchant account provider subtracts any fees related to the transactions from the balance before transferring the funds to your bank.

You need to have a merchant account before you can accept credit and debit cards. Some merchant account providers also offer payment processing services and products such as card readers, point-of-sale systems and mobile payments.

Payment gateway: This merchant service allows your company to process credit and debit cards, as well as other types of electronic payments. Online shopping, in-store shopping and paying with a credit or debit card in-store wouldn’t be possible without payment gateways.

Payment gateways provide software that transfers data about a transaction between parties. When customers provide their credit card information online, that information travels along the payment gateway to the issuing and acquiring banks. The payment gateway encrypts the card information, protecting it from third-party interception.

How Does a Merchant Services Provider Work?

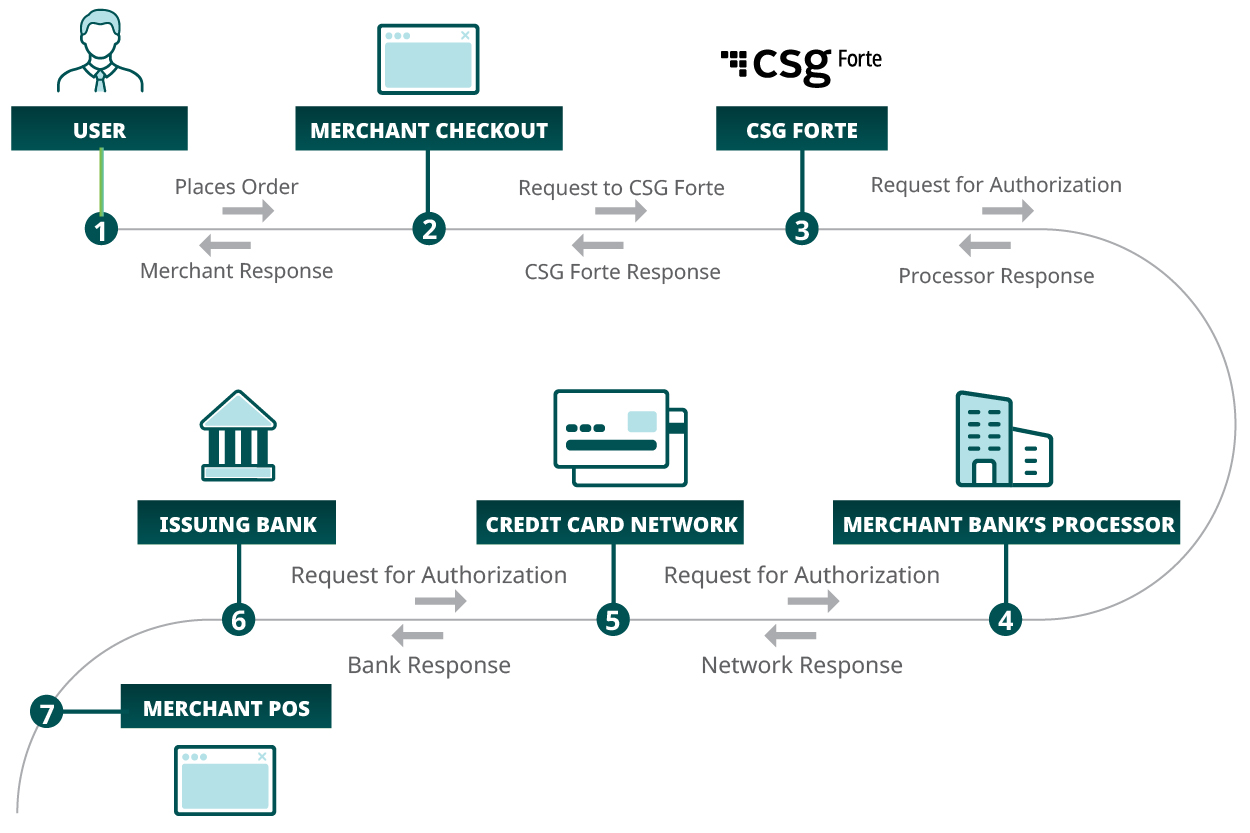

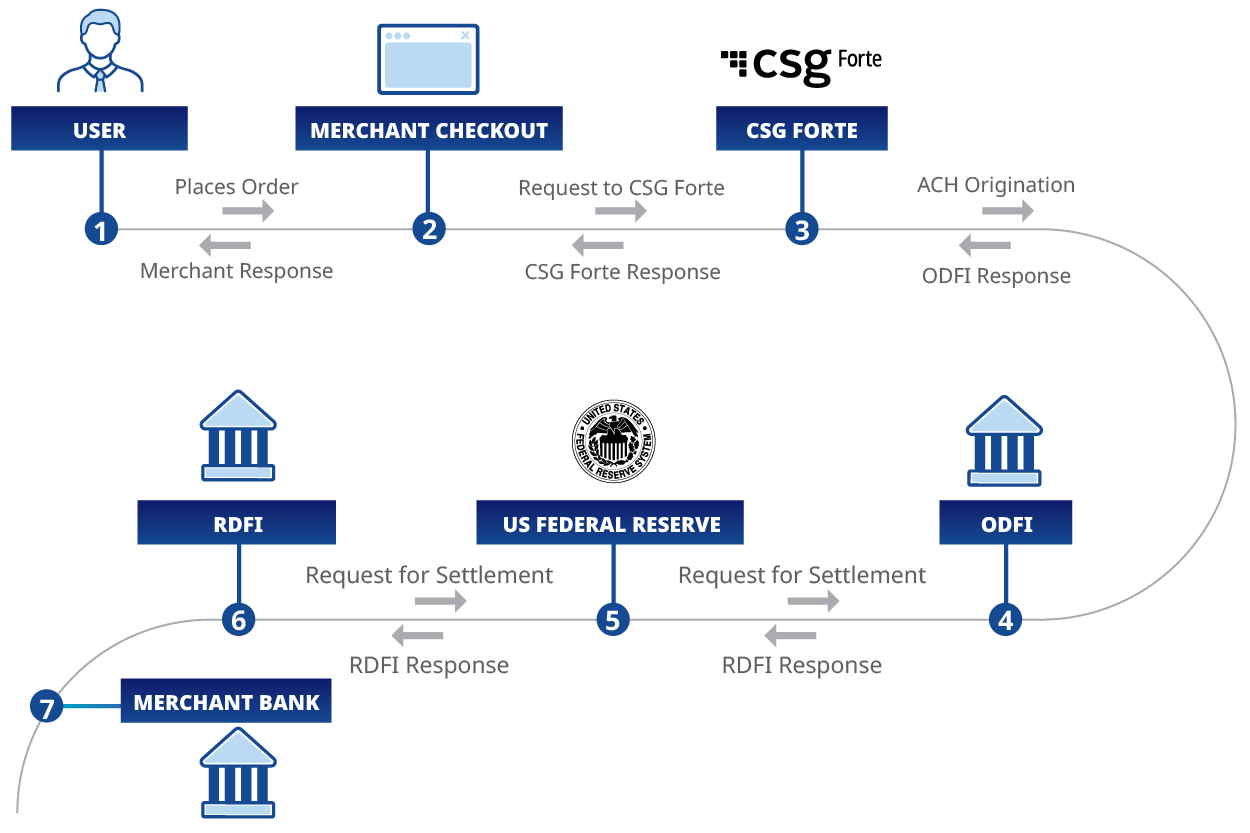

As the go-between for a business and a bank, the merchant services provider facilitates payment transactions. While a lot goes on behind the scenes when a customer makes an electronic payment, the process itself typically lasts just a few seconds. A merchant services provider goes to work once a customer provides payment information:

- The MSP sends the payment information to the acquiring bank.

- The acquiring bank passes on the payment details to the issuing bank to get authentication and approval.

- The issuing bank either approves or denies the payment.

- The approval or denial gets sent to the acquiring bank, which sends the information to the MSP.

- If the payment is approved, the merchant account receives approval and confirmation of the transaction.

- The money is transferred from the customer’s bank account or credit card to the merchant account.

Merchant Services Pricing

Several pricing models are available for merchant services. The exact pricing structure can vary based on your agreement with your MSP and based on the volume of your transactions, historical risk and claims in your sector and specifics of your operation.

How Quickly Can You Get Started With a Merchant Services Provider?

If you’re ready to work with an MSP, the first step is to gather the information the provider will need to review your company and confirm you’re eligible to receive its service. Providing as much information as possible on your application helps streamline the process, meaning you can start more quickly.

Some of the documents you’ll want to include with your MSP application are:

- Your business tax ID

- Your website

- Your mailing address

- Your business’s bank account information

What Types of Businesses Can CSG Forte Help?

If your business wants to accept more forms of payment, the team at CSG Forte can help. We offer merchant services for small- and medium-sized businesses. We’ll help your company accept electronic payments, including credit and debit cards, in-person payments, online payments and over-the-phone payments. You’ll get peace of mind that your transactions are secure, and your customers’ payment data is safe. If you have any issues with our merchant or payment processing services, our customer service representatives will assist. We help you with troubleshooting issues and provide tools to support you with customer disputes.

FAQs

Have questions about working with a merchant services provider? Check out our answers to some of the most frequently asked questions.

Do I Need a Merchant Services Provider?

If your business wants to accept credit and debit cards or other forms of electronic payments, you’ll need to work with a merchant services provider. While you’ll need an MSP, the type of MSP your business requires can vary depending on the services and the type of payments you want to accept.

What’s the Difference Between a Merchant Services Provider and Merchant Account Provider?

A merchant account provider is a type of merchant services provider. A merchant account provider can give your company access to a merchant account. Some merchant account providers also handle payment processing, but not all do.

What’s the Difference Between a Payment Service Provider and Merchant Account Provider?

A merchant account provider gives your company access to its own merchant account. Payment service providers can also provide access to a merchant account, but the account won’t exclusively belong to your business. Instead, a payment service provider groups businesses together and uses the same merchant account for them. Working with either a payment service provider or merchant account provider allows your company to accept electronic payments, although it typically takes longer to receive an account from a merchant account provider than to be approved by a payment service provider.

How Can I Know My Payment Platform Is Secure?

Security is critical. Customers want to feel confident their payment information is safe from hackers, and companies want to know that the MSPs they work with prioritize security. To ensure payment security, all payment details should be encrypted during transmission and when the system is at rest. Fraud management tools are also important, and the MSP should comply with all industry standards.

How Do I Choose a Merchant Services Provider?

Choosing an MSP can be a straightforward process. You need to assess your organization’s needs and determine which types of payments you wish to accept, then do your research and look for a provider that fits your needs. Also, consider how you want to accept payments, such as online, in person or over the phone. Pay attention to the security measures the provider has put in place, the fee schedule and the amount of customer support the MSP provides. It is useful to look for an MSP that can integrate with your existing systems or provide ample support to help you migrate over.

Choose CSG Forte for Merchant Services

Take the steps toward achieving a simpler payment process by choosing CSG Forte as your merchant services provider. Contact us today to start your application or learn more.