Everything You Need to Know About NFC Mobile Payments

When customers use their phones to pay for purchases at supermarkets, restaurants or stores, those payments are in part powered by near-field communication (NFC). NFC is a type of wireless connection that lets two devices in close proximity to each other communicate. For instance, a smartphone with NFC enabled can send data to a nearby credit card terminal.

NFC makes paying more convenient for customers and businesses. If your company isn’t yet accepting NFC mobile payments, learn more about how it works and the benefits of using it.

What Is an NFC Mobile Payment?

NFC mobile payments are contactless payments. To make a mobile payment, a person must first have a smartphone with NFC enabled. They also need to install a digital wallet app on their phone. A few different digital wallets are available, including Google Pay and Apple Pay. Each type works with a specific type of mobile device. Apple Pay works with iOS devices, while Google Pay works on either Android or iOS devices.

Once someone has a digital wallet on their phone, they can load their payment information onto it. They will provide their credit card information, including their account number, expiration date and security code. The app stores that information securely. When they want to make a payment, they can open the app, choose their payment method and wave their phone near the credit card terminal.

How Does an NFC Mobile Payment Work?

NFC is a type of radio frequency identification (RFID) that lets devices communicate when they are within a certain range of each other while NFC is enabled. Most smartphones let users toggle NFC on and off. RFID isn’t new—it’s been used for decades in barcode scanners. However, NFC is a newer form of RFID—it’s been in use just since the start of the 21st century.

NFC uses a specific frequency that lets devices talk to each other when they are very close together. For an NFC payment to work, the user typically needs to place their mobile device about two inches away from the NFC-enabled terminal.

When an NFC-enabled mobile device with a digital wallet app installed gets within range of an NFC-enabled credit card terminal, the two devices start talking. When a customer opens their wallet, the NFC device will prompt a form of authentication, such as facial recognition, a fingerprint scan or a personal code. After confirming the user’s identity, the NFC device and terminal will establish a secure connection.

The smartphone sends encrypted payment data to the terminal, which then sends that data to the appropriate banks. The banks approve or deny the transaction, the data gets sent back to the terminal and mobile device, and the payment is completed (or declined).

The entire process takes just a few seconds. It’s usually much faster than swiping or inserting a credit card for payment and quicker than handing over cash and waiting for change.

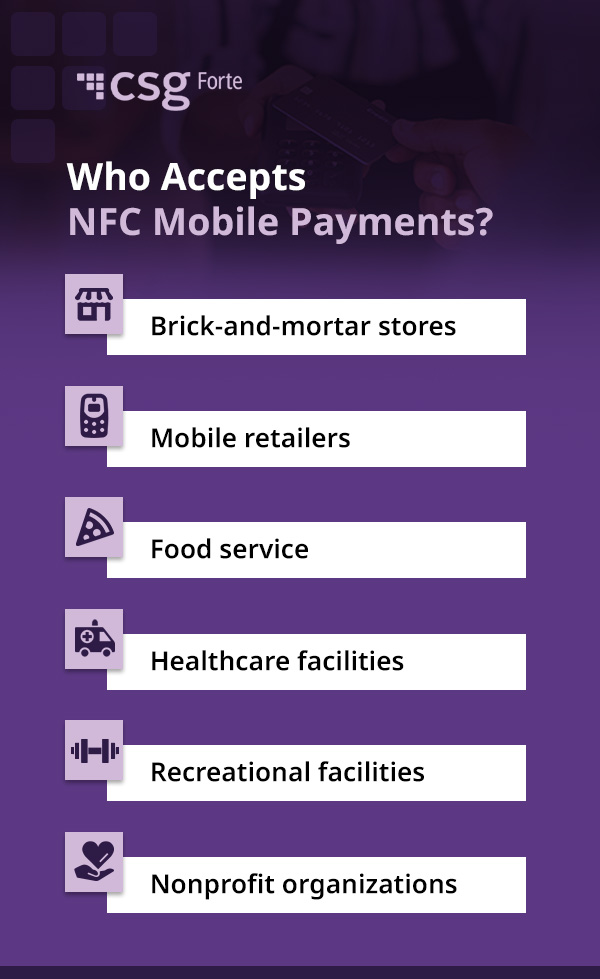

Who Accepts NFC Mobile Payments?

Many kinds of businesses use NFC payments. Although this method is rarely the only option a business offers, adding it to the list has many benefits. Businesses that process many payments in one day can especially benefit from NFC. This includes businesses like:

- Brick-and-mortar stores: Antique dealers, clothing stores, home goods stores and similar locations offer NFC mobile payments.

- Mobile retailers: Street vendors, flea market booths and similar traveling retailers can increase convenience with NFC payments.

- Food service: Dine-in and carry-out restaurants offer NFC payments for contactless payment at the table or during pickup.

- Healthcare facilities: Contactless NFC payments are common in pharmacies, hospitals, therapist offices, dental offices and other healthcare facilities.

- Recreational facilities: Gyms, fitness centers and facilities serving individual customers can appreciate NFC payments.

- Nonprofit organizations: NFC payments are an excellent way to enable convenient donations and fundraising.

Advantages of Using NFC Mobile Payments

NFC payments offer benefits to businesses and consumers. If you haven’t yet started accepting mobile payments, here are a few reasons to do so.

1. They’re Fast

A lot happens when a customer presents their mobile phone to pay, but it all happens nearly instantaneously. That’s because data travels from phone to terminal more quickly through NFC than it does when a card is physically swiped or inserted into the machine.

All that speed is good news for business owners, as it allows them to serve more customers in less time. It’s also good news for buyers, as they don’t have to wait a long time at the checkout counter for a sale to complete.

2. They’re Convenient

Who hasn’t forgotten their wallet at home, only to realize it when they’re at the front of the checkout line? With mobile payments, all a customer needs to do is pull out their smartphone to pay for their groceries, meals or new wardrobe.

NFC payments also allow for a smoother transaction process. Most people keep their phones within easy reach, but their wallets are securely tucked into a bag or pocket. Using mobile payment eliminates the need to dig around for a wallet. Customers also don’t have to wait for change or spend time counting out the correct number of bills.

3. They’re Secure

NFC mobile payments are as secure (if not more) than card payments—and they’re way more secure than using cash. If someone loses cash or has their wallet stolen, there’s no way to get it back. However, if someone loses their smartphone, they can lock it down to prevent anyone from accessing it or their payment information.

Digital wallets often have multiple security features built in to prevent unauthorized access. For example, a digital wallet may open up after the phone’s owner scans their fingerprint. Some apps use facial recognition software and only open after scanning the phone owner’s face. A slightly less secure option is for the app to require a person to input a code or draw a pattern before getting access.

When sending data from the phone to the credit card terminal, digital wallets encrypt the information. If a third party intercepts the payment data, they’d have to spend a lot of time and effort cracking the code and deciphering the information.

Some digital wallet apps also use a security measure called tokenization. Once the user provides their payment card information to the app, the app creates a series of random numbers, which it then uses in place of the payment card. Outside of the NFC payment system, the random numbers are worthless. If a third party gets access to them, they wouldn’t be able to use them for anything.

4. They Give Customers More Options

For some customers, the more payment options they have, the better. Adding NFC mobile payments to your business’s point-of-sale (POS) system means your customers have another choice when it’s time to complete a transaction. They can feel confident running to the store with only their phones.

5. They’re Flexible

Most digital wallets allow customers to use them for in-person payments—such as when someone is picking up their morning coffee or grabbing groceries after work—as well as for online payments, such as placing a weekly Amazon order.

6. They’re Easy to Set Up

Your business needs a terminal that accepts NFC payments before you can start accommodating digital wallets and mobile payments. If you use a complete payment solution, your card terminal will already be NFC-enabled, making it easy to start accepting digital wallets.

Once you have an NFC-enabled terminal, your business is ready to accept mobile payments from customers, speeding up their time in the checkout line and making life more convenient for everyone involved.

The Difference Between NFC and EMV

Europay, MasterCard and Visa (EMV) payments often appear alongside NFC payments in discussions, as they are both authenticated payments. While both methods offer convenient, secure and authorized payment methods, these methods use different technologies. EMV payments reflect the move away from magnetic strips and toward chip card payments. In many cases, swapping existing terminals to embrace modern models will allow you to embrace both payment types, expanding your flexibility. There may be other crossovers as well. For example, users may complete NFC payments by placing their device near the “tap” terminal location that accepts EMV payments. Additionally, some EMV-chipped cards support NFC technology.

NFC Mobile Payments Examples

Digital wallets turn smartphones into payment methods. The type of digital wallet a person has installed on their device depends on the operating system. Here are some of the most readily available NFC payment digital wallets.

Apple Pay

Apple Pay works on iOS devices, such as the iPhone, and preinstallation means users don’t have to download the app on their own.

Apple Pay users can save their credit or debit card information to the app, plus membership cards and gift cards. Individuals in the United States have the option of using an Apple Card or Apple Cash, which is a digital prepaid card. Users can choose which payment method to use as their default payment.

When someone wants to use Apple Pay to complete a purchase, they need to open and unlock the app using FaceID or their password.

Samsung Pay

Samsung Pay is similar to Apple Pay but only works on Samsung devices. It works the same way Apple Pay does, letting individuals save their membership cards, gift cards and debit or credit card details. Users can also take advantage of a prepaid Samsung card when using Samsung Pay.

For security, the app only opens after scanning the user’s iris or fingerprint.

Google Pay

While Apple Pay only works with iOS and Samsung Pay only works with Samsung, Google Pay works on Android and iOS devices. It allows users to save payment information that they can then access to make payments from the Google Pay app or when using the Chrome browser.

To use Google Pay, a person needs to verify their identity. They can use their fingerprint or a personal identification number (PIN) or draw a special pattern.

Addressing Payment Security With NFC

Like any payment method, understanding security risks and how to overcome them is crucial for your business and customer peace of mind.

A unique risk for NFC payments is an “eavesdropping” attack. NFC payments typically occur within short distances. The eavesdropping strategy allows unauthorized devices to receive a customer’s NFC signal during their transaction. This process can capture the information the customer is transferring, including card information. While this method typically requires equipment and a specific distance range, attackers will likely find ways to make overcoming these barriers easier.

Skimming is another possible risk. This attack strategy involves creating a fraudulent payment terminal to modify the existing one. The fraudulent terminal can capture the information of all NFC users who interact with it, which attackers can use to conduct unauthorized transactions or clone cards.

It is crucial to implement effective security strategies to combat these risks. Regular security checks, monitoring transactions and incorporating physical security can decrease the likelihood of an NFC attack. Proper staff training and partnering with reliable terminal and software providers can enhance your security practices and boost peace of mind.

Embracing NFC Payments With CSG Forte

Are you ready to accept mobile payments at your brick-and-mortar location? CSG Forte’s payment solution can help. Our platform makes it easy for customers to pay using their chosen method, whether it’s their digital wallet, a physical card or cash.

If you’re ready to streamline payment at your business, contact CSG Forte today to learn more about our payment solutions.