Move Funds Faster With Same-Day ACH Transfers

Automated clearing house (ACH) payments have become critical for everything from electronic bill payments to direct payroll deposits. Same-day ACH is one of the latest improvements to the ACH network that enables the processing of credit, debit and return transactions multiple times daily. Same-day ACH transfers ensure that payments are deposited into another account on the same day with absolute certainty.

Supporting over 98,000 merchants, CSG Forte is a leading payments provider of same-day ACH. We leverage decades of experience with best-in-class software to deliver a seamless and scalable solution to businesses operating in a comprehensive range of verticals, including healthcare, government, property management, insurance, utility companies and integrated software vendors.

What Is Same-Day ACH Transfer?

ACH utilizes a batch processing system to submit transactions multiple times per day. Financial institutions, businesses and consumers move money between accounts using ACH. Same-day ACH ensures your transfers go through on the same day you initiate them, as long as the initiating party executes them by a specific time. The same-day ACH cutoff time tends to be around 3:00 pm, so we recommend submitting 30 minutes to an hour before then.

Although it’s not a real-time payment method, ACH allows transfers to process faster than the several days it took years ago. Some of the key players in same-day ACH payments are the National Automated Clearing House Association (NACHA), receiving depository financial institutions (RDFIs), originating depository financial institutions (ODFIs) and third-party processors like CSG Forte.

In 2015, NACHA added windows that offer quicker same-day processing and settlements for ACH transactions due to consumer demand and continuous lobbying from industry experts. Before these changes, it usually took two to three business days to process a typical ACH transaction.

Benefits of Same-Day ACH Credits and Debits

Businesses that utilize ACH same-day services to move money between accounts experience benefits like:

- Optimized control of cash flow: Shortening the ACH processing window gives users faster access to their funds, often on the same day.

- Decreased cycling times: Same-day processing reduces the time it takes to deliver funds into a user’s account with automated processing.

- Higher transaction limits: Recent increases to same-day ACH limits enable businesses to complete more substantial transactions faster.

- Affordable transaction costs: Users can enjoy the advantages of quicker payments without the increased costs associated with credit cards and manual payment methods.

- Reduced outstanding payables: Same-day ACH options save time for your accounting department by minimizing the number of balances owed to you.

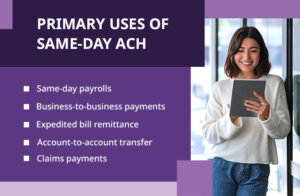

Primary Uses of Same-Day ACH

Businesses, financial institutions, government agencies and consumers that use same-day ACH transfers benefit from moving money between accounts faster. In the early days of ACH, consumer disbursements like payroll and insurance payouts represented the primary development. Today, much of the growth involves account-to-account transfers and bill payments for consumers and businesses.

Some of the most popular applications for same-day ACH transfers include:

- Same-day payrolls: These cases involve companies issuing payroll to workers through fast direct deposits while offering flexibility for missed deadlines, late payrolls and emergency distribution.

- Business-to-business payments: These transaction types provide quicker invoicing payment settlements between trading partners, including the remittance information.

- Expedited bill remittance: This category covers the ability to use ACH credits and payments that allow consumers to pay their bills on the due dates without penalty and offer faster crediting for late payments.

- Account-to-account transfer: These transactions provide faster crediting for consumers who move money between various personal accounts.

- Claims payments: These cases include quick payouts like disaster assistance and insurance claim payments, tax refunds and other types of reimbursements.

Same-Day ACH Transfer Cutoff Times and Transaction Limits

The cutoff time for submitting a same-day ACH transfer is 4:45 p.m. EST. Any transaction initiated after that time will not go through until the following business day. For example, if you execute a transfer after 5:00 p.m. on a Friday, it will post on the following Monday.

In March 2022, NACHA increased the individual transaction limit for all eligible same-day payments from $100,000 to $1 million. This update focused on various types of larger transactions, such as insurance claim payments, payroll funding and business-to-business tax payments.

Many financial institutions put limits on ACH transfers, primarily the number of daily and monthly transactions a user can execute. These limitations apply to incoming and outgoing transfers and often vary depending on the institution.

How CSG Forte Can Help Your Business

Same-day ACH payments are a crucial component of the modern payment landscape and a critical part of an effective digital payment strategy. At CSG Forte, transaction processing is the core of our payments platform solution. Our software makes it easy to manage all your ACH payments, including same-day transactions.

Our comprehensive approach to ACH allows businesses to disburse funds and collect remittances reliably and efficiently. Same-day ACH capabilities enable your company to turn customer payments into usable funds faster.

By using innovative and optimized solutions, our payments platform can change what was previously an operational expense into a revenue generator. Our solution streamlines ACH payments by validating transactions in real-time, keeping recurring payments on track and automatically reprocessing failed transactions.

Contact the Experts at CSG Forte Today

If you’re interested in learning more about ACH transactions and how same-day payments can optimize your business, the team at CSG Forte can help. Contact us online today to get started.