What Can ACH Processing Do for Your Business?

From computer with physical data tapes that had to be driven from bank to bank, to modern, fully digital clearing houses, Automated Clearing House (ACH) processing has become an integral part of digital commerce. In 2021, over 29 billion payments valued at $72.6 trillion were processed over the ACH Network. To put this in perspective, the amount of money exchanged between consumers, businesses and governments last year could cover the cost of one 2022 Ferrari Portofino Ms for every person in the United States. Contactless payments especially have turbocharged this trend as more consumers seek out frictionless payments on the phone. Whether these take the form of tap-to-pay wallet type experiences or purely digital contactless payments, each of these frictionless payments is an opportunity to employee ACH in your business.

But let’s get back on track. What is ACH processing, and how could ACH processing impact for your business

WHAT IS ACH?

ACH processing is one of the key ways to securely send and receive money, for credit and debit card payments For example, when your paycheck is deposited into your checking account, your employer is depositing your pay via ACH processing. Or, conversely, if a customer makes a payment for your goods and services, the bank associated with your customer’s credit or debit card can deposit your funds directly to your business account.

ACH was designed to support increasing payment volumes as the world began to transition to automated payments. In the 1970s, financial transaction volumes were becoming difficult to manage with early computer infrastructure. As a result, the Federal Reserve stepped in to fund an automated system build and use computer programs specifically designed to process and settle payment claims between financial institutions.

With ACH, merchants can process check and card payments without making authorization requests to credit card networks or issuing banks. Instead, ACH processing goes through the Federal Reserve or the clearing house to secure payments from a Receiving Depository Financial Institution (RDFI). The RDFI then posts the payment into the requestor’s account.

All of this means that instead of paying network fees to a credit card company, ACH payments cost much less to process. This ends up saving the merchant money with every transaction. And very soon, merchants will have a chance to collect even more money with ACH.

The National Automated Clearing House Association (Nacha) has repeatedly raised the daily transaction limit for ACH. This means that not only do ACH payments cost merchants less, but they can also accept much larger payments (up to $1 million per day) and recognize revenue faster.

ACH VS. CREDIT CARDS: WHAT IS THE DIFFERENCE?

No matter what payment options you offer, customers want to pay in the most convenient ways for them. Often, this means they will use a credit card or another form of digital and contactless payments. But added convenience can also add costs. So what happens when a credit card payment is processed in the traditional way?

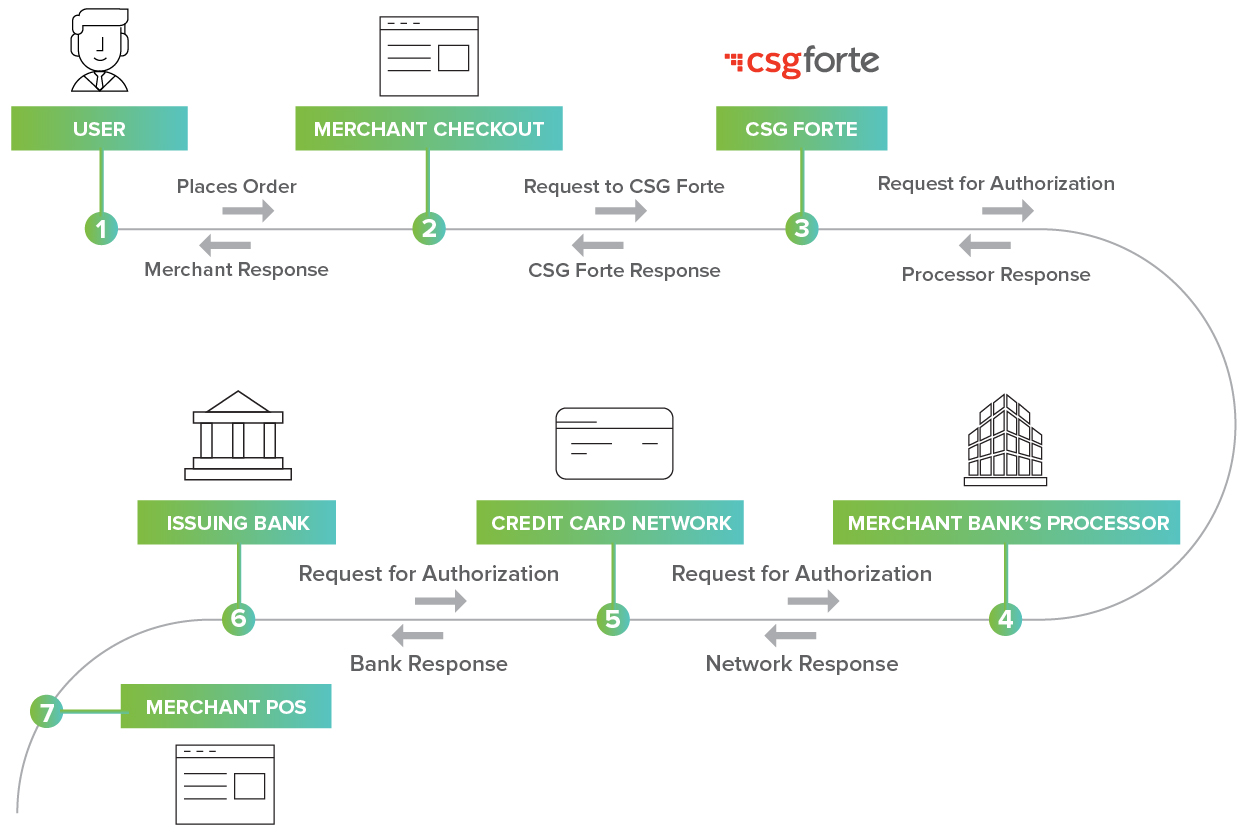

- The customer places their order or makes a purchase. The card information is received at point of sale.

- The merchant checkout accepts the card information and sends it to a service to manage the interactions with the merchant’s bank.

- The service sends the information securely to the merchant’s bank processor.

- The merchant’s bank processor then contacts the credit card network, like Visa or Mastercard

- The credit card network then sends the request to the issuing bank for the customer’s credit card.

- The issuing bank determines if the purchase is authorized and returns that information to the credit card network who sends it back to the merchant’s bank process.

- The merchant’s bank then sends to the merchant’s point of sale confirming if the payment is approved or declined.

Each of these steps adds cost. Not only does the merchant pay a nominal fee, known as payment settlement or interchange, to process the transaction, but the credit card network and issuing bank charge fees to the merchant for each credit card transaction made by their customers.

ACH PROCESSING

At first glance, the ACH payment process looks very similar, but there are a few core differences.

The ACH processing starts the same way at the point of sale before entering a processor’s system. But that’s where the similarities end.

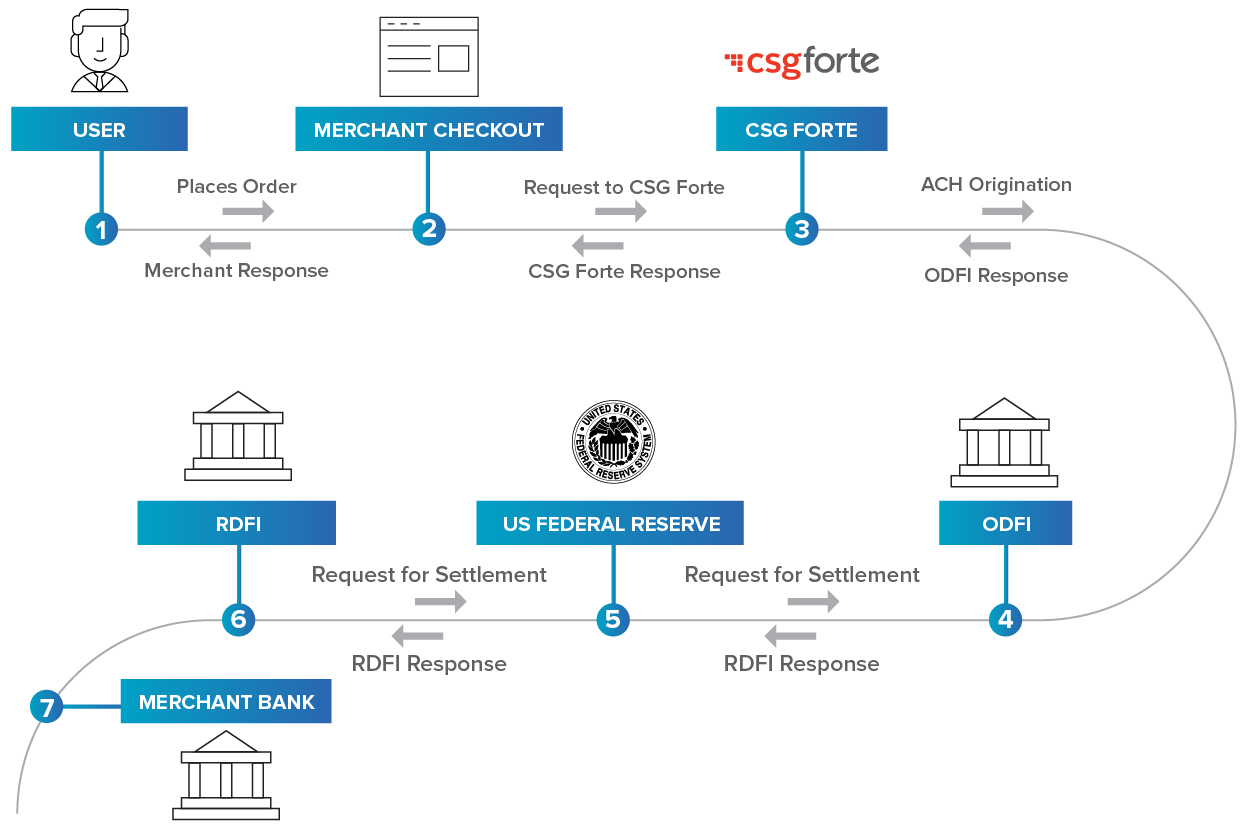

- The customer makes a purchase. The card information is received at point of sale.

- The merchant checkout accepts the card information and sends it to a service to manage the ACH transaction.

- The ACH processor handles confirmation by contacting the Originating Depository Financial Institution for origination of the payment.

- The ACH payment request is sent through the Originating Depository Financial Institution which then requests settlement from the Federal Reserve.

- The Federal Reserve then confirms that the payment is valid with the Receiving Depository Financial Institution.

- The Receiving Depository Financial Institution (RDFI) then responds, sending confirmations back down the chain in reverse to approve or deny the payment.

- Funds are sent directly to the merchant’s bank account.

These last three steps are what make the difference in cost and security between ACH and traditional credit card payments. Because ACH avoids navigating several fee-incurring steps, the end result is less costly and more reliable, especially when dealing with high transaction sizes as large as one million dollars.

STANDARD VS. SAME DAY ACH PROCESSING

One major benefit of ACH processing is the speed with which a merchant can receive customer funds. For most ACH processors, this means that funds may be available as soon as the next day, depending on when the transaction occurred. However, Same Day ACH is a newer process, one that allows merchants to receive funds the same day the purchase was made.

Why does Same Day ACH processing matter? It’s simple. Same-day processing means merchants collect funds faster. This maximizes the benefit you can generate from ACH payments. Effectively, Same Day ACH lets merchants access their payment funds quicker so that they can invest in their businesses quicker. The increased cashflow from faster processing and fewer fees than processing credit card payments means that businesses who use Same Day ACH can get back to doing what they do best and worry less about transaction costs.

However, most payment processing companies do not offer Same Day ACH. And if they do, they do not own the technology. This means that merchants working with payment processors not owning the technology receive additional fees for processing Same Day ACH.

CSG Forte is different. CSG Forte owns the Same Day ACH technology and can offer merchants the ability to receive funds quicker and at a cheaper price than working with other payment processors.

WHY GET ACH PROCESSING FOR YOUR BUSINESS?

Simply put, ACH processing allows businesses to receive and have access to payment funds faster. Not only that, but the larger daily transaction limit means merchants can access more payments funds via ACH quicker, as well. Beyond the speed and convenience of ACH, businesses save money on each ACH transaction. Because they don’t need to pay settlement or interchange fees that arise from merchant networks, merchants can secure a larger chunk of each transaction. Especially when considering that compared to cash and paper checks ACH is also more secure and cannot be physically lost, it’s a powerful tool for businesses in many industries, from retail to healthcare and from financial services to real estate and telcos.

With the power that a great ACH solution can bring to your payments, it is no wonder that so many brands are adding it to their toolbox. However, if you’re interested in learning more about ACH processing or how you can get the most out of ACH with Same Day Processing, CSG Forte can help.

Ready to learn more about ACH and how it can drive more value for your business? Check out CSG Forte’s ACH processing capabilities.