What Are ACH Return Fees & How Do They Work?

When handling transactions with Automated Clearing House (ACH) payments, awareness of ACH returns is a must. While these ACG payment returns are not commonplace, it’s possible to experience them every now and then, especially if the bulk of your transactions are ACH payments.

ACH payments are electronic transfers regulated by the National Automated Clearing House Association (NACHA). These payments rely on the routing and account numbers of the sender and recipient to move funds from one account to another. These transactions process in one to three business days, and they often cost less to use than credit and debit or wire transfers.

In addition to payments to providers and merchants, ACH payments are often used for direct deposit from employers, recurring bill payments, business-to-supplier transactions and many other scenarios.

Standard and mobile ACH payments are a notable aspect of modern businesses. As a merchant or provider, receiving notice of an ACH return means you don’t receive the money you’re owed. Knowing what these returns are and how to respond ensures you earn your expected revenue.

What Are ACH Return Charges Or Refunds?

You may be asking, why did I get an ACH refund or return? An ACH return charge occurs when the payment transaction fails to be completed. These failed transactions are referred to as “returns” because the money will return to the originator’s account, rather than transferring to the recipient. The merchant will never see the money in their account when an ACH return occurs.

An ACH return scenario starts with a standard ACH payment. A merchant will send a request to debit a client’s account, and the involved ACH network will receive the request. The network will then send the request to the client’s bank to fulfill the transaction. If all required conditions are met, the payment will go through.

In circumstances where the required conditions aren’t met, the client’s bank will alert the ACH network that they cannot complete the transaction. The money then stays in the client’s account—this is an ACH return.

ACH payments are a generally secure and reliable form of payment, and these returns likely only make up a small fraction of payments. However, understanding how they work can simplify the resolution process.

Important Terms for ACH Payments

When discussing ACH returns, it’s valuable to understand the different terms involved in the transaction. There are two parties affected by an ACH return:

- Originating Depository Financial Institution (ODFI): The ODFI is a financial institution that has agreed to request funds with an ACH operator. The operator will enter funds into the ACH on behalf of the ODFI. Most banks are ODFI-approved, meaning they approve ACH transfers. Other types of ODFIs can include payment gateways, payment processes and ACH payment APIs. In the case of an ACH return, the ODFI does not receive the money that is owed for a given transaction.

- Receiving Depository Financial Institution (RDFI): The RDFI is the bank being debited or credited in an ACH transaction, meaning they respond to an ACH payment. Just as most banks are ODFI-approved, many are also RDFI-approved. The RDFI alerts the ACH network when a transaction cannot be completed in an ACH return.

What Causes ACH Return Charges?

There are various reasons an ACH return might occur, and some are more common than others. On an RDFI’s end, an account may lack sufficient funds to cover the charge. Other times, the account may not be authorized to fulfill the transaction, or the payment information could be incorrect.

ACH payments don’t process in real time like credit or debit card transactions, so there is always a chance something could change between the time the ODFI requests a payment and the RDFI processes the transaction. ACH returns can come down to a small mistake, like a mistyped account number. Many times, these returns are simple to resolve with a phone call or two, especially when dealing with a returned mobile ACH payment. More complex causes for these returns can involve revoking authorization, which may involve more time to resolve.

Codes to Know for Common ACH Return Fees

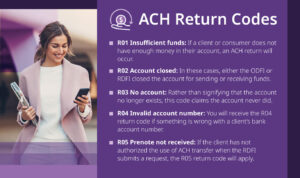

Understanding the reason for an ACH return is key to recovering the funds your company is owed. To make the resolution process possible, the ACH network provides return codes that signify the reasons for the failed transaction. Examples of return codes include:

- R01 Insufficient funds: If a client or consumer does not have enough money in their account, an ACH return will occur. This reason typically occurs when a customer has unknowingly overdrawn their account. Returned mobile ACH payments are common in this case.

- R02 Account closed: In these cases, either the ODFI or RDFI closed the account for sending or receiving funds. If you know you haven’t closed your account, your client or customer has likely closed theirs.

- R03 No account: This reason differs slightly from R02. Rather than signifying that the account no longer exists, this code claims the account never did. R03 can also arise if the account’s owner is not the same as noted by the debit entry.

- R04 Invalid account number: You will receive the R04 return code if something is wrong with a client’s bank account number. R04 ACH returns can also result in the account number not passing the validation process for completing the transaction.

- R05 Prenote not received: If the client has not authorized the use of ACH transfer when the RDFI submits a request, the R05 return code will apply.

There are more than five return codes, but these five are among the most common. Of these codes, R05 works differently from the other four. The return time frame for this code is 60 days instead of two days. This longer time frame exists so the originator has time to provide authorization before the ACH return becomes official.

Other return codes may involve the RDFI requesting a return, the client submitting a stop payment request, and other more complex scenarios. These codes are subject to evolve as ACH payments become more common.

What Happens if an ACH Payments is Returned?

If ACH payments are returned, you—as the merchant or provider—don’t receive the money you need for your product or service. Once you receive a return code for the transfer, you can move forward with the next steps.

In accordance with NACHA, the RDFI and ODFI are responsible for handling the resolution of these returns. While the provider and the client can contact each other directly to discuss the issue, the return cannot be undone until at least one of the involved financial institutions is contacted.

For example, if you receive the R02 return code, you can reach out to the client and ask them about their closed account. It’s possible the client switched banks and forgot they had an ACH arrangement with you. The client can then set up ACH payments with their new bank, and you can contact your bank to alert them of the change. With ACH debit return charges, your bank can retract the debit request from your client’s old account and make arrangements for the new account.

Other return codes may involve direct discussions with your bank or the RDFI. An R04 return code may need further explanation as to why the account number did not pass the validation process. Getting more information from the financial institution can help you determine if you need to reach out to the client, or if there was an issue on your end.

Sometimes, you may also receive a Notice of Change (NOC) in addition to an ACH return. These two alerts are separate, but they’re not mutually exclusive. NOC occurs when a customer’s bank account information changes as a result of a merger, shift in the account or another reason. You might receive the R04 return code with a NOC where the RDFI will send updated account information for the ACH request.

NACHA compliance requires operations to keep their rate of ACH returns below 15%. For administrative returns—R02 to R04—the return rate must be 3% of transactions or lower. These percentages are notably larger than the practical percentages of returns, so managing this aspect of compliance shouldn’t be challenging.

What Are ACH Return Fees?

Return fees are similar to transaction fees. When a client or customer causes an ACH return, they will be charged anywhere from $2 to $5 in response to the return. This fee is similar to the cost that comes with a bounced check, so ACH payments can bounce. Financial institutions charge these fees because it costs additional funds to process an ACH return.

How to Dispute ACH Returns and Charges

ACH returns can be disputed in certain circumstances. To qualify for a disputed return, your return must meet one of the following:

- The request was misrouted.

- The request was a duplicate.

- The information was incorrect.

- The transaction was not returned in the proper time frame.

- The receiver incurred unintended credit as a result.

With most ACH returns having a turnaround time of two days, these disputes must be handled efficiently. Returns that meet one of the five conditions must be sent in within five days of the return’s settlement date. Once the dispute has been received, the RDFI still has the ability to contest the dispute. If contesting occurs, the dispute is no longer an issue within the ACH network.

Streamline ACH Payments With CSG Forte

Payment operations can be complex. If you want to use ACH payments at your organization, simplify the process with CSG Forte’s Dex. Our payments platform automates all processes through a cloud-based solution. Save time managing administrative hurdles and cut down on the costs related to resolving problems.

Dex supports online, in-person and mobile ACH payments. Built-in account verifications, recurring payment capabilities and returns management make every process simple. We have experience working with small- and medium-sized businesses (SMBs), enterprises, government organizations and integrated software vendors.

Get in touch with us today to learn more or get started by opening an account.